Tax gets social: digital marketing and financial incentives for small business

Over the past year we’ve seen a number of tax incentives on offer for small business, including a reduction in the company tax rate, an increase in the instant asset write-off threshold and, in the digital arena, the tax deductibility of expenditure on intangible...

It’s FBT time again

FBT season is in full swing with only a month to go until the due date for the lodgement of the return on 21 May 2018. If you haven’t started getting the required information together, now is the time. Remember if you give benefits to any current, prospective or...

Business cash payments on ATO’s radar

Cash might be king, but the use of cash by businesses is attracting attention from the ATO. It will begin visits of selected businesses to ensure that all tax obligations are met. Third-party data and risk analysis is being used to identify the types of businesses the...

SUPERANNUATION GURANTEED

Paying the right amount of superannuation to your employees can at times be a complex exercise, with the threshold changes in the recent years and the contribution base which changes every year according to indexation factors. With the rise of the gig economy there’s...

Airbnb and home sharing: Tax Implications

Do you rent out a part of your home, or a holiday home, on Airbnb, Stayz or another sharing site? Perhaps you see this as a way of making a little extra income to help the household budget or to save for that holiday. But what you may not be aware of are the long term...

Are you signed up to the ATO’s small business super clearing house?

The ATO's small business superannuation clearing house (SBSCH) is a convenient service that allows a small business to make superannuation contributions for its employees in one single payment. It’s important to know that access to the service has recently changed...

First Home Super Saver Scheme: lay foundations and plan to benefit

Even if you avoid café brunches and keep a close eye on your everyday spending, saving a deposit to buy your first home can be a challenge. The First Home Super Saver Scheme, announced in the 2017–2018 Federal Budget, proposes using the superannuation system to help...

Tax Debts to Affect Your Credit Score

Tax debts could soon affect the credit scores of businesses, with the government’s introduction of draft legislation to allow ATO to share debt details of businesses to credit rating agencies. The proposal only applies to businesses that meet certain conditions and...

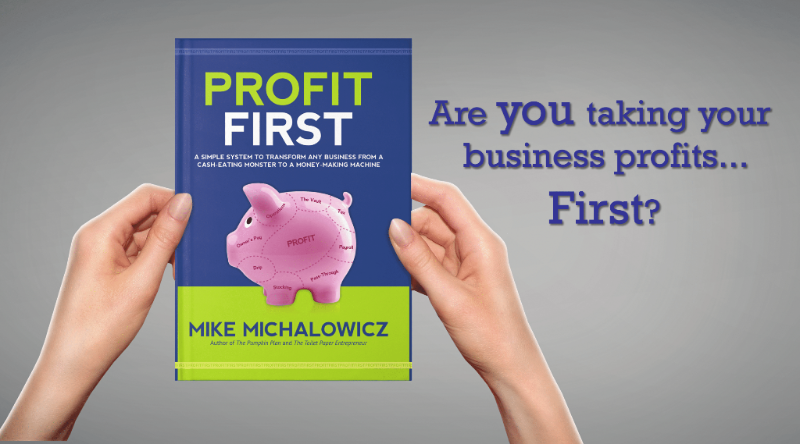

Destroying Debt with Profit First

We all have debt, don’t we? We all hate debt right? Do we all have good concepts around paying ourselves first and managing debt? Have you been raised with the belief that debt can be a good thing? Haven’t we be raised believing that we need credit to get a good...

How Profit First Changes the Game

We are all in business to make a living, pay our bills and of course to make a profit. Yet every second person I speak to tells me “I haven’t paid myself ever,” “I can’t afford my bills,” “I can’t pay my tax.” But when we sit down and look at their figures using the...